Former CPU rival Intel and AI giant Nvidia form a century-long alliance

Table of contents

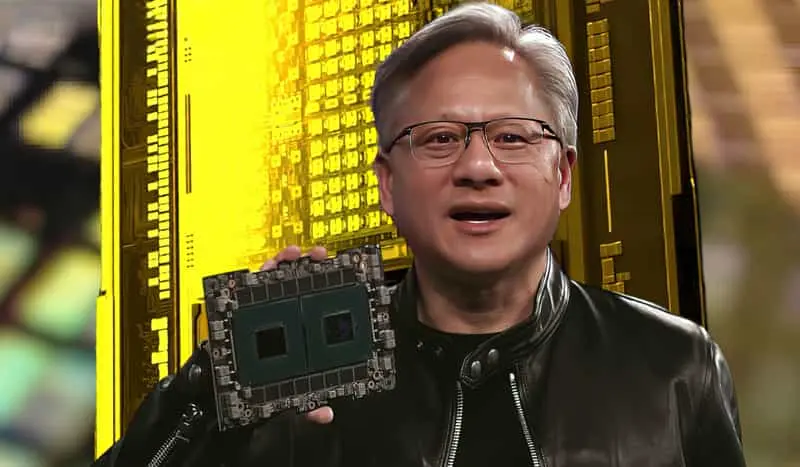

Major CPU manufacturersIntelWith AI OverlordNvidiaAlliance On September 18, 2025, the global semiconductor industry welcomed a shocking "marriage of the century" - CPU giant Intel and AI computing power leader NVIDIA announced the establishment of an in-depth strategic cooperation, with NVIDIA investing US$5 billion (about HK$39 billion) in Intel. And NVIDIA spent 5 billion U.S. dollars (about 39 billion Hong Kong dollars) into Intel, the two sides will be in the data center, personal computers and edge computing and other areas to develop multi-generation customized product development, and jointly attack the huge market of more than 50 billion U.S. dollars in total size. This is not only a simple financial investment, but also a historic event with deep geopolitical connotations and the reorganization of the industrial ecosystem. It marks the end of the traditional "walled-off" competition model and the advent of a new era of "coopetition" and "alliance against alliance".

For Taiwan, a technology island with semiconductor manufacturing and electronics foundry as its economic lifeline, this strong alliance across the Pacific Ocean is not just a ripple, but a wave of impending tsunami. It not only brings the deep concern of being marginalized, but also contains a huge opportunity to enter the emerging ecosystem. This article will analyze the background of the formation of this alliance, its core content, its far-reaching impact on the global and Taiwan industries, and try to draw a possible strategic blueprint for the future.

"From competitors to strategic allies, the two countries join forces.

Since its founding in 1968, Intel has been the leader in the global CPU market, and its x86 architecture has been the industry benchmark for personal computers and servers. However, in recent years, facing the challenge of AMD in the field of high-performance CPUs and the rise of GPUs under the wave of AI, Intel has been under tremendous pressure in both technology and market.

NVIDIA's CUDA platform and high-performance GPUs have given it a commanding lead in AI training and deep learning. However, NVIDIA's penetration in PC integrated graphics and x86 ecosystems is relatively limited, relying mainly on external CPU vendors to provide computing power support. In this partnership, the two companies are complementing each other's strengths: Intel provides advanced CPU technology, x86 ecosystem and manufacturing capabilities; NVIDIA contributes its powerful AI acceleration engine, CUDA software ecosystem and NVLink high-speed interconnect technology. In this way, both parties can not only make up for their own shortcomings, but also jointly develop new market space.

Transaction core details:

- Size of investment: Nvidia is acquiring approximately 4% of Intel for $5 billion in cash, priced at $23.28 per share, a significant premium to Intel's share price prior to the announcement.

- Scope of cooperation: The two sides signed a multi-year Memorandum of Understanding (MOU) on a wide range of cooperation focusing on three core areas:

- Data Centers and AI Infrastructure: Co-development of a new generation of server platforms that deeply integrates Intel's Xeon series CPUs with Nvidia's GPUs (such as the Blackwell architecture and its successors) and optimizes NVLink high-speed interconnect technology, with the goal of creating the world's top-performing AI training and inference system.

- AI PCs and terminal devices: The joint design and development of a next-generation System-on-Chip (SoC) combining Intel's x86 CPU cores, NPU (Neural Network Processing Unit), and Nvidia's RTX GPU technology is designed to define the future standard of the "AI PC" and to drive the popularity of edge AI computing.

- Software and ecosystem integration: Promote some degree of compatibility and collaboration between Nvidia's CUDA and Intel's oneAPI and other software frameworks, to provide developers with a more unified and efficient programming environment, and to reduce the software level barrier.

The market reacted immediately:

The global capital market was abuzz with the news, and Intel's stock price soared 22% to 26% in a single day, the biggest one-day increase in more than a decade, indicating that the market has high expectations for the alliance, which is seen as a shot in the arm for Intel to turn around its fortunes. nvidia's stock price also rose slightly, with analysts saying that this move will help nvidia consolidate its AI ecosystem and develop a wider range of hardware carriers. Analysts believe this will help Nvidia consolidate its AI ecosystem and develop a wider range of hardware carriers. Meanwhile, some competitors such as AMD are under pressure, with the market worried that it will face a stronger joint attack on both CPU and GPU.

Core contents of cooperation

| Areas of cooperation | Main measures | Anticipated Effects |

|---|---|---|

| Data Center | Intel Customizes x86 CPUs for NVIDIA, Integrates into NVIDIA AI Platform; Introduces NVLink High-Speed Interconnection | Improving AI training and inference efficiency, reducing latency, and capturing the $30 billion data center CPU market |

| Personal Calculation | Intel Introduces x86 SoCs with NVIDIA RTX GPUs | Enhancing Graphics and AI Performance for Laptops and Workstations, Expanding the $20+ Billion Integrated Graphics Market |

| Marginal Calculation | Co-development of low-power, high-performance edge AI chip | Satisfy low-latency requirements for intelligent transportation, industrial automation, etc. |

| Technology Ecology | Shared software and interfaces to accelerate application development | Simplify cross-platform development and promote the deep integration of software and hardware. |

Why are the former rivals joining hands today?

This "marriage of centuries" is not a coincidence, but an inevitable result of corporate strategy, industrial change and geopolitical forces.

Nvidia's Strategic Motivation: From Hardware Vendor to Ecosystem Empire Anxiety

While Nvidia has become a leader in the AI era, with a market capitalization that once topped the world, its core business model carries two potential risks:

- "TSMC Dependency": Its most advanced GPU chips rely entirely on TSMC's advanced manufacturing processes (e.g. 3nm, 2nm). Against the backdrop of intensifying geopolitical risks, a single source of supply is the biggest vulnerability in its supply chain. The introduction of Intel as a potential second source will greatly enhance the resilience and bargaining power of its supply chain.

- The boundary of ecosystem expansion: Although the CUDA ecosystem is strong, it is mainly rooted in data centers. To truly realize the vision of "AI everywhere", it is necessary to conquer the end-device, especially the huge market of PC. However, the CPU core of the PC market is still dominated by Intel and AMD. Working directly with Intel is the fastest way for Nvidia to embed its GPU and AI technologies into billions of end-devices, the ultimate expansion of its eco-empire.

Intel's Strategic Salvation: The Triple Need for Survival of the Jedi

Intel's motivation is even more urgent, and can be described as a "desperate" strategic shift.

- Financial blood transfusion: In recent years, Intel has fallen behind TSMC in the advanced process race, and has been left far behind by Nvidia in the AI chip space, resulting in revenue and profitability pressures, while capital expenditures have become increasingly large. 5 billion in cash injections have provided valuable capital assistance to its foundry business (IFS) and process R&D (e.g., 14A, 18A), which are burning money.

- Technical and ecological recognition: The acquisition of Nvidia's shares is tantamount to obtaining a "technology endorsement" from one of its biggest competitors. This sends a strong signal to the market that Intel's technology and manufacturing capabilities are still recognized and in demand by the industry's top players. This is crucial to boosting customer confidence in Intel's foundry services.

- Responding to national strategies: Intel is one of the biggest beneficiaries of the US Chip and Science Act, receiving huge subsidies and loans. The U.S. government owns about 10% of its shares, making it essentially its largest strategic shareholder. Partnering with Nvidia to build a US-based AI and semiconductor leadership alliance is fully in line with the US national strategy of "technology independence" and "supply chain repatriation", and provides Intel with a more solid policy backing.

Geopolitical Push: The Shaping of the U.S. High-Tech 'National Team'

Behind this alliance is the shadow of Washington. Against the backdrop of an increasingly heated tech competition with China, it has become a bipartisan consensus to ensure absolute U.S. leadership in two key technology areas: AI and semiconductors. A "Team USA" that is internally united and strong is far better than a "marquis pattern" that is characterized by serious internal conflict and fragmentation. The government has facilitated this alliance through subsidies, policy guidance, and even direct shareholding, with the intention of creating a technological aircraft carrier battle group that is competitive externally and synergistic internally.

Collaboration at its Core - Full Integration from the Cloud to the Edge

The alliance is not just a paper exercise, and its technical cooperation extends to a number of key areas.

Data Center: Attacking the Holy Grail of AI Computing Power

The future joint server platform will no longer be a simple "CPU+GPU" plugged into the same motherboard, but rather a deep synergistic design from the architectural level.

- The interconnectivity revolution: The current PCIe interface has become a bottleneck in data transfer. The new platform will fully adopt Nvidia's NVLink-C2C technology to realize ultra-high-speed, low-latency interconnections between CPUs and GPUs, which will increase the data exchange efficiency by a few times, thus greatly unleashing the overall performance of AI training clusters.

- Memory Unification Site Search: Both parties may explore shared or unified memory architectures that allow the CPU and GPU to share and access data more efficiently, reducing unnecessary data movement and further improving efficiency.

- System level optimization: Everything from power management and cooling solutions to firmware and software drivers will be integrated to provide cloud service providers (CSPs) and hyperscale data center customers with an out-of-the-box, best-of-breed solution.

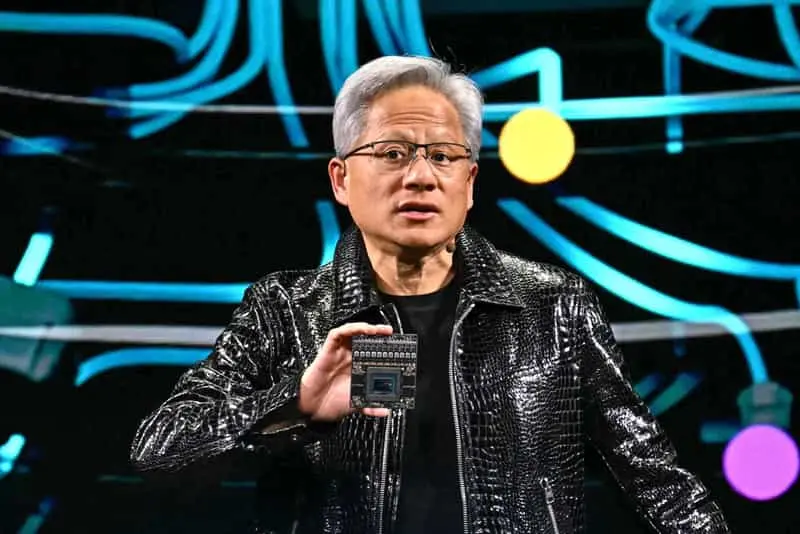

AI PC: Redefining Personal Computing

This is probably the part that will have the most direct impact on the consumer market. The so-called "AI PC" collaboration aims to create a true "Super SoC".

- Heterogeneous Computing Fusion: The new SoC will no longer be a simple patchwork of CPU, GPU, and NPU. Instead, through advanced packaging technologies (such as Intel's Foveros), the three different architectures of the computing units will be tightly integrated to realize intelligent scheduling and synergistic computation of tasks. Lightweight AI tasks are handled by the NPU, complex graphics and AI are undertaken by the GPU, and general-purpose computation is undertaken by the CPU, achieving the best balance between performance and power consumption.

- Localized large model runs: The goal of such chips is to enable consumers' laptops or desktops to run billions or even tens of billions of generative AI models with billions of parameters locally to perform tasks such as text-to-map, text-to-video, and advanced programming assistance without relying entirely on the cloud, which will lead to lower latency, better privacy protection, and a more disruptive user experience.

- Eco-discourse competition: Whoever defines the hardware standard for AI PCs will have a say in the next-generation PC ecosystem, and Microsoft's Windows and its Copilot+ ecosystem will be a key partner at the software level, with the Intel-Nvidia alliance aiming to compete with competitors such as Apple's M-series chips and Qualcomm's X Elite series for the right to define it.

Manufacturing and Packaging: The Ambush of the Future

Although the first round of cooperation did not explicitly include Intel's foundry services (IFS), this is undoubtedly the most suspenseful and imaginative aspect.

- The "dual-source strategy" was tested: For Nvidia, having some of its product lines (e.g., specific AI PC chips or certain versions of its data center GPUs) on Intel's foundry is a great opportunity to validate its process capabilities and diversify its risk.

- The ultimate test of Intel's foundry business: If we can successfully produce a chip that meets Nvidia's stringent requirements, it will be the most powerful publicity for Intel's 14A/18A process, reversing the decline of its foundry business and truly becoming a strong competitor to TSMC and Samsung.

- The benchmark for American made: If a "Made in USA" Nvidia chip were to be created in the future, its political symbolism would be as important as its commercial value, and it would be a perfect fit for U.S. national strategy.

The Shock and Restructuring of the Global Industrial Chain

The impact of this alliance will radiate to every corner of the global technology industry.

Taiwan's Industrial Chain: A Crossroads of Opportunities and Challenges

Taiwan, as the world's leading semiconductor and electronics manufacturing center, has been the most directly and profoundly affected.

- Challenge:

- TSMC's long-term concerns: In the short term, TSMC's leadership in advanced manufacturing processes (especially 2nm and below) will remain unassailable, and Nvidia's top AI chips will still be OEM'd by it. However, in the long run, Intel's position as a potential second source of supply and the U.S. government's determination to localize production capacity will gradually erode TSMC's absolute dominance. TSMC must continue to accelerate technology innovation to maintain its "irreplaceable" lead.

- The pressure of the OEM model: If Intel's partnership with Nvidia succeeds, it will signal the resurgence of IDM 2.0 (Integrated Device Manufacturing), which is in direct competition with TSMC's foundry model. Global customers will have more considerations when choosing a foundry, including geopolitical risk and supply chain diversification.

- ODM/OEM readjustment: Taiwan's notebook foundries (e.g., Quanta, Compal, Wistron) and server manufacturers (e.g., Quanta, Inventec) must quickly adapt to the new Intel-Nvidia joint platform and redesign their product blueprints, which implies a re-investment of R&D resources and an adjustment of the supply chain.

- Opportunities:

- A wave of AI PCs and terminal devices: Taiwan manufacturers are at the forefront of the AI hardware revolution. New AI PCs, AI servers, and edge-to-edge AI devices will bring a wave of replacements and new manufacturing demand. Taiwan's strong ODM/JDM (Joint Design and Manufacturing) capabilities make it the ideal partner for international brands to implement AI hardware products.

- A key player in advanced packaging: Heterogeneous integration and advanced packaging are key to realizing these high-performance SoCs, regardless of who makes the chips. TSMC's CoWoS, SoIC and other technologies, as well as the strength of major packaging and testing companies such as Sun Micron and Li-Sung, will become even more important in the future, and Taiwan still has a strong advantage in this area.

- A niche market for IC design: Taiwan IC design companies, such as MediaTek, can focus on areas not yet covered by the Intel-Nvidia alliance, such as low- and mid-range AIoT devices, automotive electronics, and specific customized AI acceleration chips, to find their own niche in the huge ecosystem.

For Global Competitors: A New Game and Response

- Supermicro (AMD): AMD is facing its toughest challenge yet. Competing with both Intel and Nvidia in the CPU and GPU space, and now that the two rivals have joined forces, AMD must more clearly demonstrate the price/performance and openness advantages of its CPU (Ryzen/EPYC) and GPU (Instinct/Radeon) combinations, and may need to strengthen its partnerships with software giants such as Microsoft and Google. It may be necessary to strengthen cooperation with software giants such as Microsoft and Google.

- Cloud Service Giants (CSPs): They are both large customers of Nvidia and actively developing their own AI chips (e.g. TPU, Trainium, Inferentia). This alliance may prompt them to accelerate the pace of self-research to avoid over-reliance on a single external hardware ecosystem, and at the same time, diversify their procurement strategies to seek balance and checks and balances between Nvidia-Intel, AMD, and even self-research chips.

- Arm Eco: Intel's deep collaboration with Nvidia is a strong bundling of the x86 architecture with Nvidia's GPU ecosystem, which could somewhat dampen the expansionary momentum of the Arm architecture in the PC and server markets. Qualcomm and its partner PC vendors need to be more aggressive in demonstrating the performance and power advantages of the Arm architecture for AI PCs.

The Dilemma of Software and Open Source Communities

Nvidia's CUDA is already the de facto standard for AI development, but its closed-source nature has been criticized, while Intel promotes the open oneAPI. Ideally, the oneAPI would better support Nvidia hardware and provide developers with a more open option after the collaboration, but the more likely scenario is for the two to form a stronger and more closed "Wintel Alliance 2.0", locking developers deeper into its hardware-software ecosystem. But the more likely scenario is that the two form a stronger, more closed "Wintel Alliance 2.0" that locks developers deeper into its hardware-software ecosystem. This poses a huge challenge to the open source community and companies trying to promote alternative software frameworks (e.g., OpenAI's Triton, ROCm).

There are several changes that may occur in the consumer marketplace:

- More powerful hardware products: The Alliance may introduce powerful hardware systems integrating Intel processors and NVIDIA GPUs to deliver higher performance, especially for gaming, content creation and high-performance computing applications.

- Better energy efficiency: Collaboration on energy efficiency optimization may lead to more efficient power management and thermal design, enabling consumers to get high-performance devices with lower energy consumption.

- Software Optimization: Co-developed drivers and software tools may enhance overall system stability and performance and improve the user experience, especially in gaming and creative endeavors.

- Price Competition: Such an alliance may put pressure on market prices, prompting other competitors to adjust their pricing strategies, and consumers may benefit from more competitive prices.

- New Products and Services: New products designed for specific applications (e.g., VR/AR, AI-accelerated computing) may be introduced to meet the diverse needs of consumers.

- Ecosystem IntegrationThe collaboration between the two companies may lead to a more complete ecosystem where consumers can more easily use different devices and services, enhancing interoperability.

- Brand trust: The formation of the alliance is likely to increase consumer trust in the two brands, believing that such a collaboration could lead to more reliable and innovative products.

Geopolitics and Future Prospects

The Alliance Landscape of the New Cold War in Technology

The Intel-Nvidia alliance is a key step in the U.S.'s "systematic competition" with China in the technology sector. It aims to build an impenetrable moat from three levels: technology standards, industry ecology, and supply chain security. In the future, we are likely to see more strategic synergies between local tech companies under the guidance of the U.S. government, forming a complete closed loop covering design, manufacturing, and software applications. This will force other countries and regions, including Europe, Korea, Japan and Taiwan, to think about their own positioning and response strategies.

Implications for Taiwan Policy

Taiwan's government and industry need to address this change and respond to it proactively:

- Reinforce your irreplaceability: Continue to invest in core technologies such as advanced manufacturing processes and advanced packaging to ensure our technological leadership. Promote the upgrading of the industry from "high-efficiency OEM" to "innovative R&D".

- Promote diversified alliances: Encourage Taiwan companies to cooperate not only with the U.S. "national team," but also to establish strategic partnerships with leading companies in other regions, such as Europe and Japan, in order to avoid the risk of over-concentration.

- Cultivate native ecosystems: Support local IC design, key materials, equipment and software companies to build a more resilient local technology ecosystem and gain more autonomy in the midst of global turbulence.

Future Observations

- Product implementation timeline and performance: When will the first batch of jointly developed data center solutions and AI PC chips be available? The actual performance and market acceptance will be the first litmus test for the success of this alliance.

- Progress of Intel's foundry business: Will Nvidia eventually turn over some of its products to Intel, and when? This will be the biggest turning point in the story.

- The attitude of the regulators: Will such a deep alliance between the giants trigger scrutiny by antitrust authorities in the US and around the world?

- China's reaction: How will China respond? Will it accelerate its support for local alternatives (e.g. Huawei Rise, Cambridge) or will it seek closer cooperation with other regions (e.g. Europe, Korea)?

The New Normal of Cooperation and Competition and Taiwan's Wisdom

The alliance between Nvidia and Intel is an inevitable product of the current stage of development of the technology industry. It reveals that in an era of extreme technological complexity and heightened geopolitical risk, no single company can monopolize all the advantages. Even former rivals must find a dynamic balance between "competition" and "cooperation" to meet larger systemic challenges.

For Taiwan, this is not so much a deadly threat as it is a stark reminder and a clear signal. It is a reminder that the old order of globalization is being restructured, and that the security and resilience of the supply chain are of greater strategic value than efficiency and cost. The signal is telling us that the future competition will be ecosystem to ecosystem, and the time of fighting alone is over.

Taiwan's industries have unparalleled manufacturing flexibility, technology accumulation and international cooperation experience. In the face of change, the only way out is to embrace change, proactively participate in the restructuring of the international technology alliance with a more open attitude, and at the same time continue to strengthen its core technology and innovation capabilities. Only by doing so can we continue to play an indispensable role in the changing technological era and turn challenges into opportunities for the next leap forward. This alliance of the century is not the end, but the beginning of a brand new game.

Intel Timeline: (1968-2025)

| Time period | years | Key Events and Product Milestones | Meaning and Impact |

|---|---|---|---|

| Creation and Early Development (1968-1979) | 1968 | Robert Noyes and Gordon Moore founded Intel. | The birth of a semiconductor industry giant |

| 1969 | Launched first product 3101 Schottky bipolar 64-bit SRAM | Entering the Semiconductor Memory Market | |

| 1970 | Launched 1103 DRAM | Industry's first commercially available Dynamic Random Access Memory (DRAM) | |

| 1971 | Launched the world's first microprocessor 4004 (4-bit) | The Beginning of the Microprocessor Era | |

| 1971 | Nasdaq Listing | Become a public company | |

| 1972 | Launched the first 8-bit microprocessor 8008 | Processor Capacity Enhancement | |

| 1974 | Launched 8080 microprocessor | The first true general purpose microprocessor. | |

| 1978 | Launched 8086 processor | Introduced the x86 architecture as the basis for the successor processor. | |

| 1979 | Named a Fortune 500 company | Enterprise scale is recognized | |

| The Personal Computer Era (1980-1989) | 1980 | Launched the Ethernet standard with Xerox. | Promoting the development of network technology |

| 1981 | IBM Selects Intel 8088 Processor for First PCs | Establishment of PC era leadership | |

| 1982 | Launched 16-bit 286 processor | Built-in 134,000 transistors | |

| 1985 | Launched 32-bit 386 processor | Runs multiple software programs | |

| 1985 | Exited DRAM market to focus on microprocessors | Shift in Strategic Focus | |

| 1986 | Compaq is powered by Intel 386 processor | Industry dominance shifts from IBM to Intel | |

| 1989 | Launched 486 processor | Built-in math co-processor for the first time | |

| Technological Leap (1990-1999) | 1990 | Co-Founder Robert Noyes Dies | |

| 1991 | Launched the "Intel Inside" branding program | Enhanced brand awareness | |

| 1993 | Launch of Pentium processor | Introduced superscalar architecture for significant performance improvement | |

| 1994 | Pentium Floating-Point Computing Defect Event | Major PR crisis, replacement of processors for users | |

| 1997 | Launched Pentium II processor | Slot 1 design | |

| 1998 | Introduced Celeron and Xeon processors | Expanded entry-level and server markets | |

| 1999 | Launched Pentium III processor | Introduced SSE instruction set to accelerate multimedia processing. | |

| 1999 | Inclusion in Dow Jones Industrial Average | ||

| Challenges and periods of transition (2000-2009) | 2000 | Launched Pentium 4 processor | Mainly high clock frequency |

| 2003 | Launches Pentium M and Centrino Mobile Platforms | Revolutionizing the Laptop Market | |

| 2005 | Apple Announces Intel Processors for Mac Computers | ||

| 2005 | Launched the first dual-core processor, the Pentium D. | ||

| 2006 | Launched Core 2 Duo processor | Major breakthroughs in energy efficiency and performance | |

| 2006 | Sale of XScale Processor Business to Marvell | ||

| 2008 | Launched Intel Atom processor | Low-power mobile devices | |

| 2009 | $1.25 Billion Settlement Paid to AMD Over Antitrust Lawsuit | ||

| Recent Developments (2010-2025) | 2011 | Launched Sandy Bridge architecture Core processor | Integrated GPU |

| 2011 | Announces Mass Production of 3D Tri-Gate Transistors | ||

| 2017 | Acquires Mobileye for $15.3 billion | Entering the field of automated driving | |

| 2018 | Spectre and Meltdown Security Breach Incidents | ||

| 2019 | Apple Announces Phasing Out of Intel Processors | ||

| 2019 | Sale of cellular modem business to Apple Inc. | ||

| 2020 | NAND Flash Business Sold to SK Hynix for $9 Billion | ||

| 2021 | Pat Kissinger Returns as CEO, Announces IDM 2.0 Strategy | Reinvigorated manufacturing business and entered into foundry business | |

| 2022-2024 | Publication of process technology roadmaps (Intel 7, Intel 4, Intel 3, etc.) | ||

| 2024 | Wafer Foundry Business (IFS) Spun Off as a Separate Subsidiary | ||

| 2024 | Introducing the Core Ultra family of processors | Deepening AI PC Layout | |

| 2025 | Received US$8.9 billion investment from the U.S. government, which took a 9.91 TP3T stake. | Strengthening U.S. Domestic Semiconductor Manufacturing | |

| 2025 | NVIDIA Invests $5 Billion in Technology Collaboration | Data Center and AI PC Processor Collaboration |

Nvidia Timeline of Events:

| years | major event | Technology / Product Highlights | Impact and Significance |

|---|---|---|---|

| 1993 | Incorporation | Created by Hwang Jen-Hoon, Chris Malakowski, Curtis Primm. | Establishment of PC 3D graphics as the core direction of development |

| 1995 | Launch of the first product NV1 | Supports 3D rendering, video acceleration, GUI acceleration | Entering the consumer GPU market and laying the foundation for future GPU development |

| 1997 | Riva 128 listed | World's first 128-bit 3D processor | Sales Surpassed One Million in Four Months, Establishing 3D Acceleration Leadership Position |

| 1998 | Collaboration with TSMC | TSMC Foundry NVIDIA Chip | Establishment of long-term OEM model to ensure advanced manufacturing processes |

| 1999 | Invented GPU (GeForce 256) | Integrated T&L, texture compression, bump mapping | Redefining computing architecture and ushering in the GPU era |

| 2000 | Partnering with Microsoft Xbox | Delivering GPUs for the first Xbox | Expanding ecological impact by entering the home console market |

| 2001 | GeForce 3 cloth | First programmable GPU | A New Era of Programmable Rendering |

| 2004 | SLI Technology Launch | Multi-GPU parallel acceleration | Dramatically improve PC gaming performance |

| 2006 | CUDA Architecture Release | GPU Universal Computing Platform | Bringing GPUs to Scientific Research, AI, and More |

| 2007 | Tesla GPUs launched | High Performance Computing GPUs | Enabling supercomputing, healthcare, and weather modeling |

| 2012 | Powering AlexNet | GPU Accelerated Deep Learning | Driving the AI Revolution |

| 2015 | DRIVE platform release | Autopilot AI Platform | Entering the Automotive AI Market |

| 2016 | Pascal framework, DGX-1 launched | High Performance AI Acceleration Platform | Accelerating Enterprise AI Landing |

| 2017 | Volta Racks, Jetson TX2 Launched | Low Power AI Platform | Expanding Edge AI Applications |

| 2018 | Turing Architecture, RTX Technology Launched | Real-time optical tracking | Redefining the Game Graphics Standard |

| 2021 | Omniverse Platform Launches | Metaverse Collaboration Platform | Enabling Virtual Worlds |

| 2023 | Market capitalization exceeds US$1 trillion | GPU demand skyrockets | Become one of the top chip companies in terms of market capitalization |

| 2024 | Market capitalization of US$1.83 trillion | Strong demand for AI chips | Ranked as the third largest company in terms of U.S. stock market capitalization |

| 2025 | Market capitalization of $4 trillion | Popularization of AI applications | Consolidate global AI computing power leadership position |